One of the simple joys of being a person with a publicly accessible email (and I mean this with total sincerity) is hearing from total strangers out there.1 Take last week when I got this thoughtful note from a Canadian reader:

This wasn’t the entirety of the email. He’d recently read Drive-Thru Dreams and had some kind words about it, but mainly, he just wanted to share. And while I could have done without the gruesome visual, I can certainly get behind the impulse to overshare.

Moreover, like all good reader emails, it got me thinking about something.

The Enduring Importance of Cash

One theme I harp on again and again while talking fast food is accessibility. That means drive-thrus (and increasingly delivery) for people who are less mobile, that means a menu that has mass appeal with value (and increasingly vegetarian) options, and that means a democratic experience (no waitstaff, no good tables) that, in theory, doesn’t alienate or discriminate against diners. That also means accepting cash.

The numbers are tough to pin down, but a 2019 study by the FDIC found that 22% of American adults (63 million people) are either unbanked or underbanked—the term for people who can’t or don’t qualify for credit cards, bank accounts, and traditional financial services. The ranks of the unbanked in the U.S. are considerably higher among people of color, older Americans, and immigrants (documented or not). And the unbanked are also subject to all kinds of predatory practices.

Why is this important? Tons of reasons! One relevant example: A little less than five years ago, Sweetgreen (the purveyor of $15 salads) made a conscious decision to no longer allow cash transactions. They leaned on the familiar arguments for not taking cash: It’s quicker, safer, and more efficient. But they were also saying aloud what they’d kind of been saying quietly all along—their prohibitively expensive, healthy food is for, well, the banked.

It’s harder to budget when you use plastic. Economists explain that money and the consequences of spending it feel imaginary when not using paper.

After two-plus years of this policy, they ultimately reversed course, but not necessarily for the reasons you think. The Sweetgreen backlash was partially about financial inclusion as much as it was about ingrained consumer habits. It’s harder to budget when you use plastic. Economists explain that money and the consequences of spending feel imaginary when not using paper. (Part of why we’re all being steered into using apps is because we spend more and more often when we use them.)

Then there are the VERY REAL privacy/identity theft concerns about credit cards along with the rage from getting repeatedly spammed with email from a coffee shop in Tulsa that you went to once in 2015.

All said, this isn’t exactly a new conversation. But the pandemic has introduced a slew of new barriers to paper currency use. And with that always comes a new bumper crop of stories predicting the death of cash.

I’m An Idiot

As much as I like to be righteous and smarmy about cash, it wasn’t long after I got that death-tinged email that I realized how long it had actually been since I last used cash. The following day I took a field trip to Queens to celebrate finishing a project that took me all summer. (More on that…at some point soon.)

My agenda was both cliché and a bit involved: Birria tacos in Jackson Heights, some quality phone scrolling at the Queens Botanical Gardens, a massage in Flushing for a screwed-up shoulder, and then wontons. It was going to be 74 degrees. All I needed was good walking shoes, a G-pen, and cash.

I had everything but the cash when I got to Queens and discovered at an ATM that my debit card had expired at the end of August. It had been weeks since I last needed cash. And Queens, home to both many very small businesses and many unbanked individuals, is better and easier with cash. (Notably, there are no Sweetgreens in Queens.)

But what was I gonna do? Turn around?

The Results

Without turning this into a super boring version of Ulysses, let me just sum up the results of a cashless afternoon.

Birria: My plans to be the insufferable schmuck at the trendy birria truck fell through when I read online that it was cash only. Instead, I ended up at Nuevo Tacos Al Suadero, a taqueria under the 7 train and got birria tacos there. They were incredible and the restaurant added a $2.12 surcharge for not paying cash.

Queens Botanical Gardens: $6, took my card. Also, very beautiful~!

The massage: I also had to bail on the massage place a friend had recommended near the New World Mall because it was cash only. Fortunately, I found Winnie’s, which took my card and let me tip on it after I sheepishly explained that I hadn’t brought any cash. The good news is that it was an excellent experience with good vibes and a 10% surcharge for not paying cash.

Hitch #1

The ironic part of this extremely unscientific economic experiment is that the more conspiracy-minded opponents of cashless societies often talk about what anarchy awaits us when the grid crashes. (The boom in cryptocurrency has only complicated the theories.)

And so, fittingly enough, when I went to pay for street parking, the city’s card processing system was down. Each time I swiped, the transaction would auto-cancel and the machine would start calling 311 for some reason and stall out.

After trying three different machines with a few very pissed off drivers, I scrounged up all the coins I had and managed to pay for exactly one hour and three minutes of parking without a problem. And when I returned exactly one hour and 11 minutes later, a traffic cop had nailed me.

Fortunately, I wasn’t below 96th Street in Manhattan where an 11-minute delay will cost you $65. But going cashless had cost me. :(

Hitch #2

The last stop in my journey was White Bear, a small Chinese joint with no seating whose wontons I’d been lusting after on social media. When I got there, I knew right away that it would be cash only. And at this point, I thought for sure that my luck had turned hard.

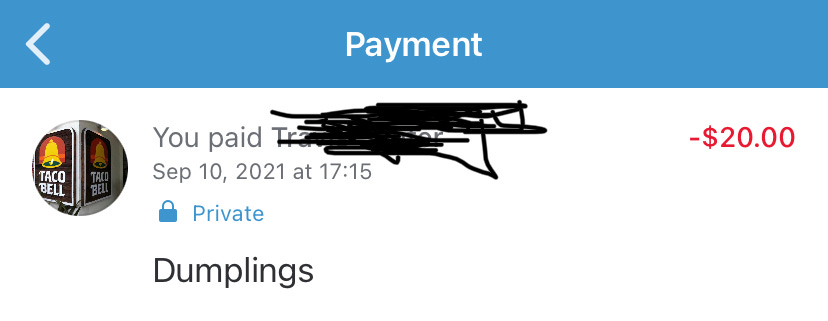

Thankfully, after a few minutes, I met a fellow snack-seeker named Travis who was having an early dinner there before the U.S. Open nearby. After explaining my situation, he agreed to let me Venmo him $20 in exchange for cold paper cash. He also advised me to get the chicken dumplings instead of the wontons and so I lied and said I would.

In the end, it all mostly worked out. And so, consider this picture my endorsement of both cash and the #6 chili oil wontons at White Bear in Queens.

Conclusions

Queens is a land of contrasts.

Discounts for paying cash are going to trickle up as profit margins thin with inflation and rising labor costs. AnnaMarie Andriotis at The Wall Street Journal recently had a good piece about this.

And if you see a place that doesn’t accept cash, try not to shop there.

That’s it for this Crunchwrap. Thanks as always for reading.

If you know a good parking ticket lawyer, hit me up. And if you’re a total stranger, please write in and say hello!

Love, Adam

TO BE SURE: I know that MANY other people have different/highly traumatic experiences with this every single day.